Executive Brief

Market Snapshot -Semiconductors

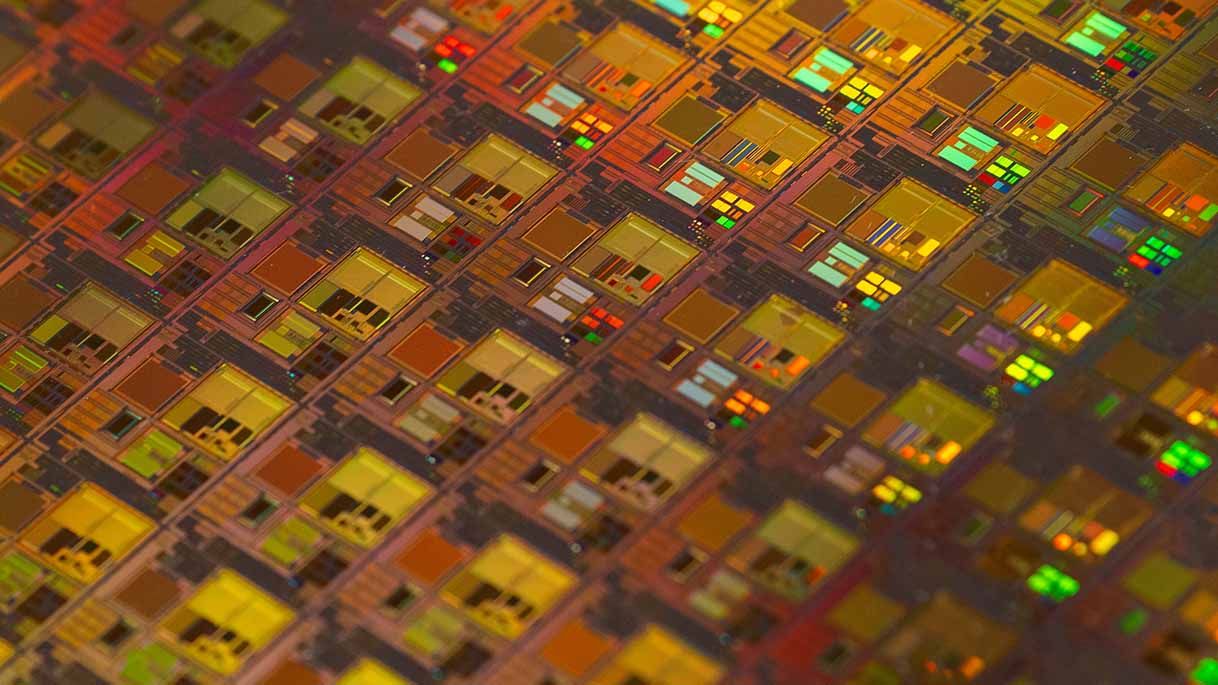

China is both the largest exporter of semiconductors and one of the largest importers, placing it at the center of the world’s chip supply chain. The geopolitical impact of China’s industry position cannot be understated. No single country has the expertise to build all types of chips itself, but a handful of leading companies – such as Taiwan Semiconductor Manufacturing Company (TSMC), Intel, Samsung, Qualcomm, and, dominant chip fabrication company, Netherlands-headquartered lithography tool manufacturer ASML Holdings (which has a 90% market share) – are industry standard setters.

Taiwan is China’s largest source of chip imports – in the first half of 2022, semiconductors accounted for 37.6% ($92.84 billion) of Taiwan’s exports to the mainland. Taiwan dominates the world’s chip supply, accounting for 48% of the foundry market and 61% of the world's capacity to build at 16nm or smaller (see box), according to market intelligence firm TrendForce. That’s why Taiwan is a prominent strategic state at the center of the geopolitical-technological race towards manufacturing advanced semiconductors.

Restricting the driving force behind China’s technological revolutionSemiconductors drive almost every technology available to us, from fridges and smartphones to drones and satellites. The military implications of advanced microchips are what caused the US Government in October 2022 to introduce a far-reaching US ban on chip and chip-making equipment exports to Chinese manufacturers, while strongly encouraging US allies to follow suit.

ASML Holdings, is arguably the most important chiprelated company in the world. The company developed extreme ultraviolet (EUV) lithography tools – a highly advanced form of etching integrated circuits onto silicon wafers. No other global chip manufacturer has access to this technology, and it has never been made available to Chinese manufacturers.

On 30 June 2023, the Dutch government – after months of pressure from Washington – announced that it would join US export restrictions by making it necessary for Dutch companies to apply for an export license to ship most deep ultraviolet lithography (DUV) systems – a less advanced system for etching chips than EUV, but nevertheless essential.

China was not explicitly mentioned, but the ban is generally considered to be a way for the US and its allies to keep advanced chip-making capabilities away from Beijing. Interestingly, ASML is the only provider of chip lithography tools to Taiwan.

Download our recent executive brief to keep reading.